Filipino small and medium enterprises (SMEs) can access a learning platform in which the world’s top companies and learning providers share their knowledge on ways to grow their businesses.

Upgraded ASEAN SME Academy (Academy) https://asean-sme-academy.org, a self-help and self-paced free online learning tool for the Association of Southeast Asian Nations (ASEAN), offers over 110 courses from 21 top United States companies.

“The Academy contains business information that is particularly relevant for regional SMEs, providing access to a curated directory of service providers to whom they can reach out for financial advice, corporate programs, and networking,” it said.

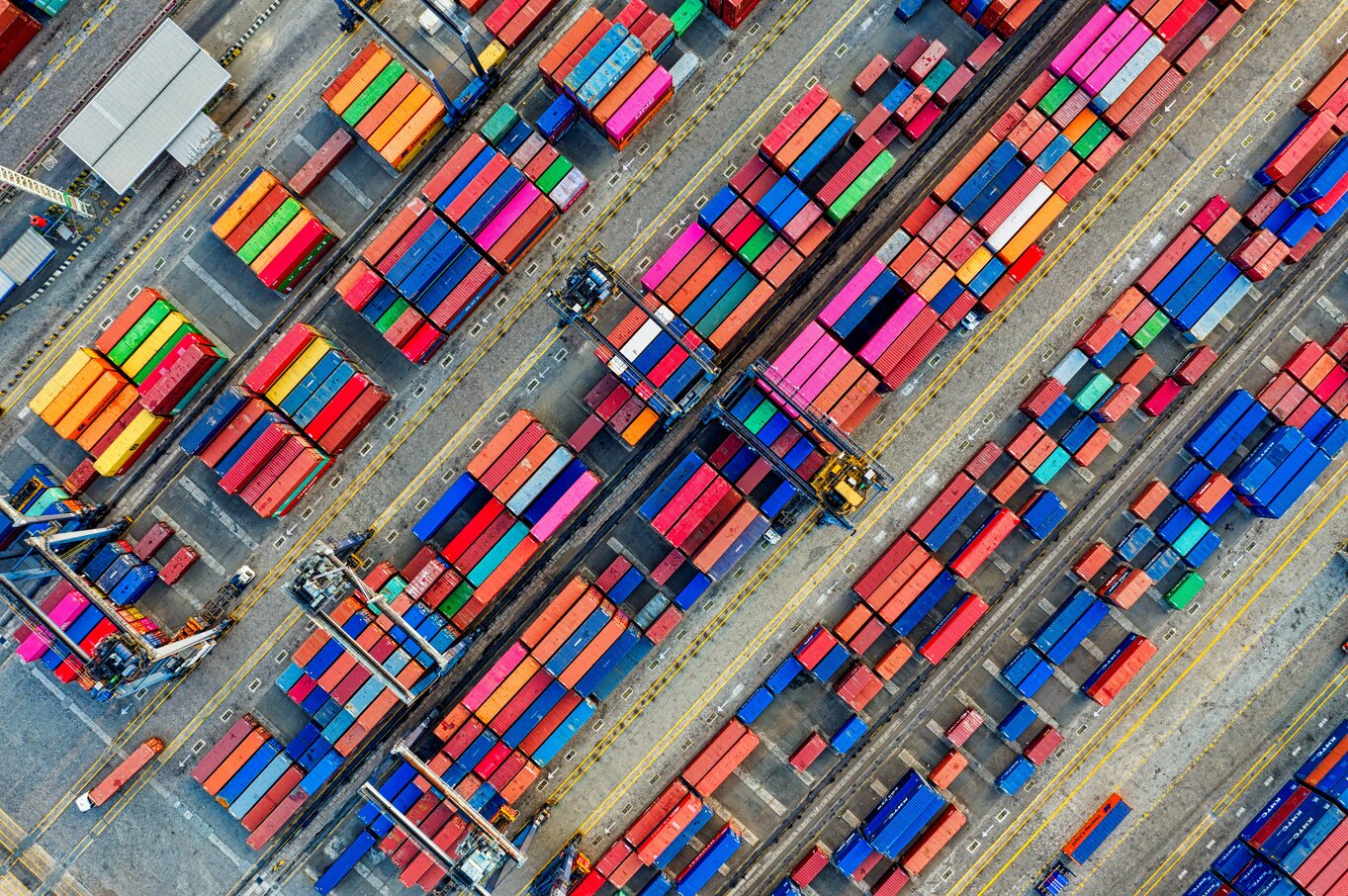

These are in areas such as finance and accounting, management, marketing, operations, technology, and trade and logistics.

The core of the Academy is a series of training materials for SMEs from Fortune 500 companies while it incorporates those focused on SMEs from regional firms and international organizations.

“This curated set of courses is part of a larger program to provide training and mentorship to enhance ASEAN SME’s access to financial products, regional and international markets, information and advisory services, and technology and innovation,” it added.

It also provides a calendar of events to give users more information about training from the business alliance and business development services in the region.

Users of the Academy will develop a user profile when first logging on to facilitate users’ access to materials specific to their industry and links to existing business support.

The information and resources will be selectively translated into the local languages to expand the group of firms that can benefit from the Academy.

Source: PHILEXPORT News and Features

Image by Freepik

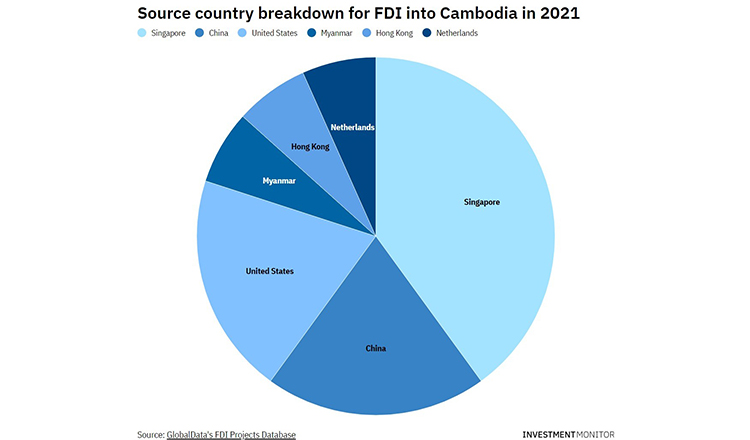

China, which held the top position in both 2019 and 2020, dropped to joint second, alongside the US, recording three projects. Myanmar, Hong Kong and the Netherlands made up the remaining investments.

According to a report by Investment Monitor, titled ‘Cambodia punches above its weight in attracting FDI,’ the Kingdom is also the third most attractive investment location for foreign money in Asia Pacific after Singapore and New Zealand.

“Cambodia is a lesser-known FDI location in South East Asia, must compete against the likes of Singapore and Vietnam to attract inward investment. Despite the stiff competition it has managed to win more than its fair share of greenfield projects,” the report said.

The Index measures a country’s inward investment levels against its gross domestic product (GDP) using GlobalData’s FDI Projects Database, which tracks greenfield projects. “This means that Cambodia, with a score of 3.26, received more than three times its fair share of inward greenfield FDI compared with what could be expected given its level of GDP. In that regard, Cambodia is punching well above its weight in FDI terms,” the report said.

According to it, FDI peaked in Cambodia in 2019, with 43 projects. In terms of capital investment, this represented a 15.5 percent increase over 2018 figures, to $3.7 billion, said the UN Conference on Trade and Development’s 2020 World Investment Report.

For full article, please read here

Author: Manoj Mathew

Source: Khmer Times

As technology, sustainability and other major global shifts fundamentally reshape the way we operate, how can businesses enthuse and empower their workers with the skills to stay relevant and competitive?

Staff retraining is the modern mantra – and enterprises can seek guidance from refreshed Industry Transformation Maps rolled out by Singapore's Future Economy Council. The maps help firms across 23 sectors to equip employees with skills for greater value creation.

Two companies that have invested time and resources into cultivating their staff are now reaping outsized rewards. Their key message: To plug the labour drain, retain & retrain.