GLOBAL trade, the key building block of international growth, is often seen as an indicator of how the global economy and, by extension businesses across the world, are faring.

Based on World Trade Organization (WTO) numbers released earlier this year, global trade volume grew 2.7% in 2022, with the value of world merchandise trade rising 12% to US$25.3 trillion (about S$34.7 trillion), and world commercial services trade up 15% to US$ 6.8 trillion. Digitally delivered services exports were at US$3.82 trillion in the same year.

The fastest growing sectors for merchandise trade were energy-related. Other top performers were agricultural products and manufactured goods such as automotive products and clothing.

In the commercial services trade, computer services was the most dynamic sector with world exports at 45% above pre-pandemic levels reflecting demand for software, cloud services, machine learning and enhanced cybersecurity.

WTO estimates also show an almost fourfold increase in value, from 2005, for global exports of digitally delivered services. This includes services traded cross-border through computer networks, that is through the Internet, apps, emails, voice, and video calls, and increasingly, through digital intermediation platforms such as online gaming, music and video streaming, and remote learning.

The Asia-Europe Trade Corridor

The wars raging in Ukraine, and more recently the Gaza Strip, have cast a pall on the global trade outlook for 2023 and even 2024. But businesses across the world need to persevere, and major trade channels such as the Asia-Europe corridor continue to connect countries together in a complex export-import web to facilitate these businesses.

According to the HSBC Asia-Europe Corridor Outlook 2023 – Forging Deeper Connections report, the Asia-Europe trade corridor is a major component of the global economy with one of the world’s highest trade volumes.

The 51 countries of the Asia-Europe Meeting (Asem) account for 65% of the global economy, 60% of the global population, 75% of global tourism, and 55% of global trade.

The 21 Asem countries contributed 36% of EU international trade in goods in 2020 and were the destination of 27% of exports from the EU, and the origin of 45% of EU imports.

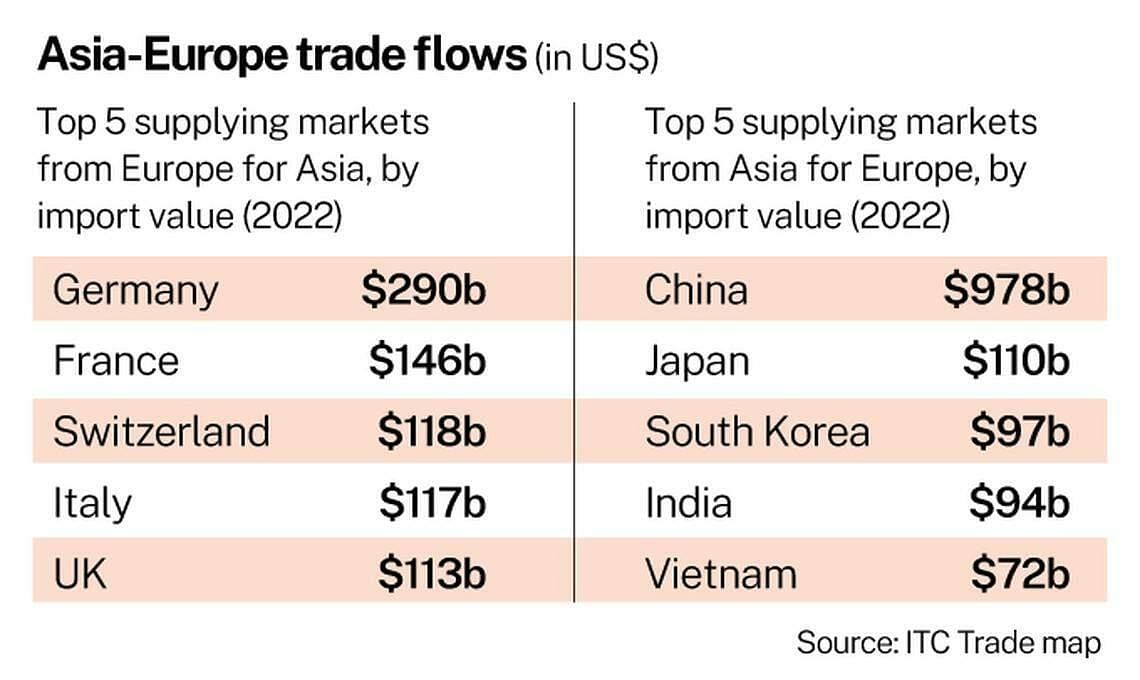

China and India play a critical role in Europe’s trade with Asia. China was the top destination for Europe-5’s (comprising France, Germany, Ireland, the Netherlands and the UK) exports to Asia in 2022. Collectively, China, Asean and India accounted for 50% of Europe-5’s exports to Asia.

European investors tap opportunities in Asean’s digital economy, worth almost US$200 billion of gross merchandise value in 2022. This is expected to hit US$330 billion by 2025, powered by e-commerce, travel, food and transport, and online media.

In Asia, China and Singapore have consistently received the most foreign direct investments from 2017 to 2022, with US$189 billion and US$141 billion, respectively, invested in 2022 alone.

Asean

No discussion on global trade is complete without highlighting Asean’s contribution. Asean’s GDP growth exceeds much of the rest of the world: it grew 30% from 2011 to 2021, compared with global growth of 23% over the same period. As a trade bloc, Asean’s US$3.66 trillion GDP (2022) makes it the fifth largest economy after the United States, China, Japan, and Germany.

Visualise this: In 2030, one in six households entering the world’s consuming class will be in an Asean country, as the region’s population is forecast to hit 723 million and consumption is expected to drive its GDP to an estimated US$4.5 trillion.

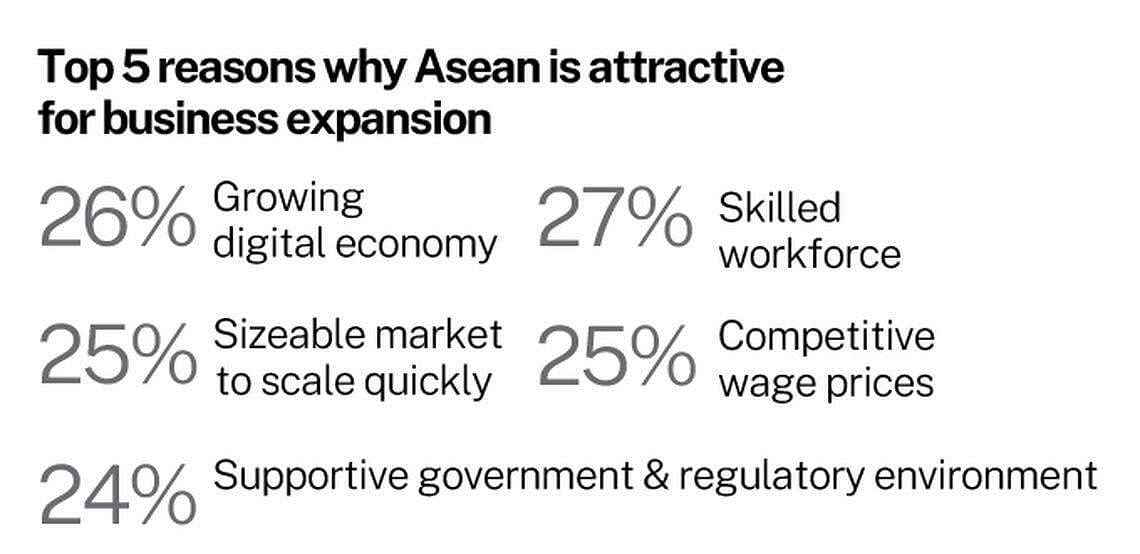

The region is likely to be a key driver of trade growth because of a number of factors fuelling its consumption boom: Demographic growth; urbanisation; developed ecosystems for digital trends; rise of Tier 2 cities; and high-value-added services.

Five key markets, collectively known as the Asean-5, are fostering growth within Asean: Malaysia, Indonesia, Singapore, Thailand, and Vietnam. HSBC’s report (Asia-Europe Corridor Outlook 2023 – Forging Deeper Connections) states that as at 2021, Asean-5 accounted for 84% of Asean GDP and 72% of the region’s population

Growth pains

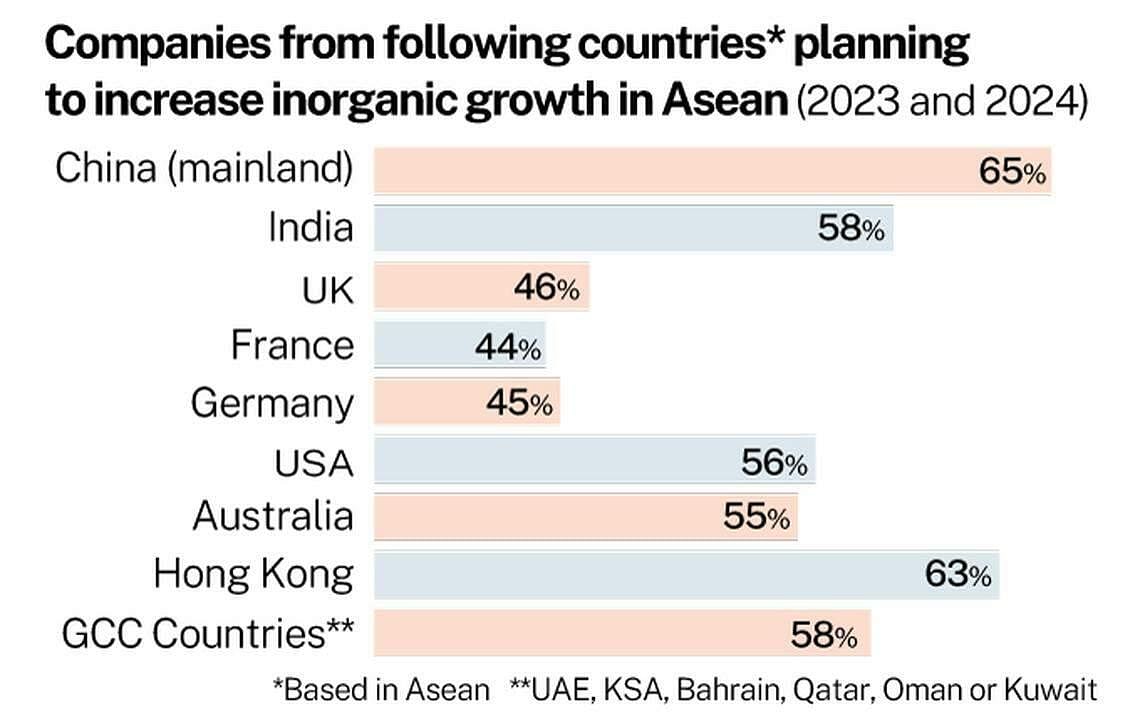

International companies based in Asean recognise that its large markets, able and affordable workforce, and improving infrastructure, all position the region positively for technological innovation.

Growth enablers: Digitalisation

- Digitally delivered services exports worth US$3.82 trillion in 2022, with almost 25% of such services originating from Asian economies. (Source: WTO)

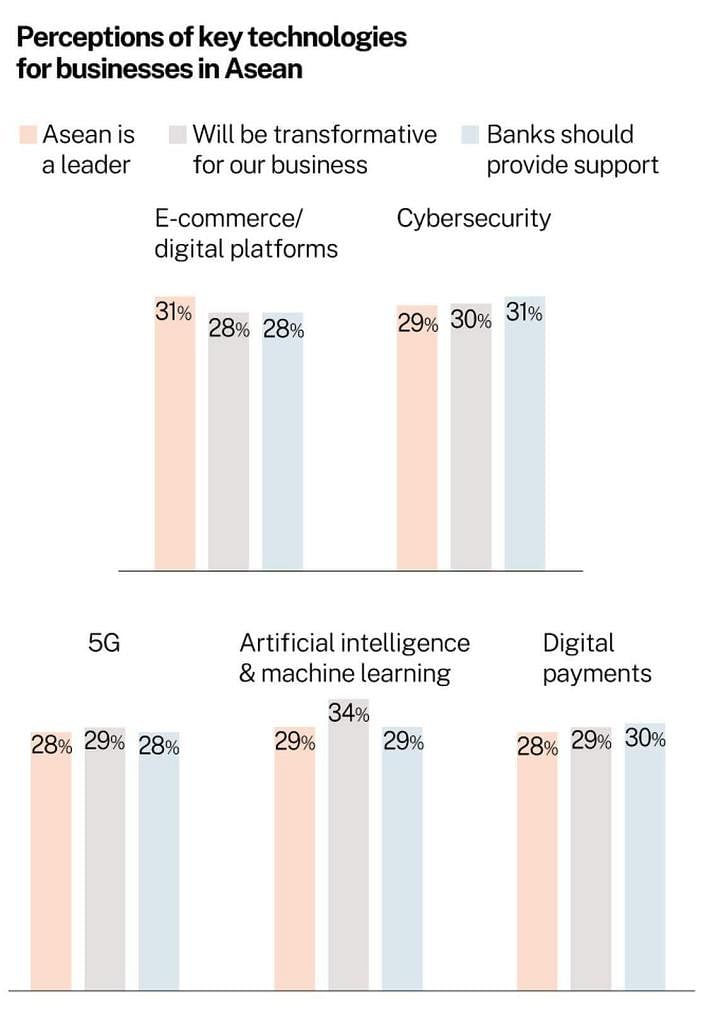

- Asean’s digital connectivity is an attractive factor for international businesses.

- Three in 10 (31%) of international businesses believe Asean is leading in e-commerce and digital platforms. Digital payments seen as the region’s strength.

- International businesses in Asean plan to invest an average of 8.3% of operating profit in technology and digitalisation over the next 12 months.

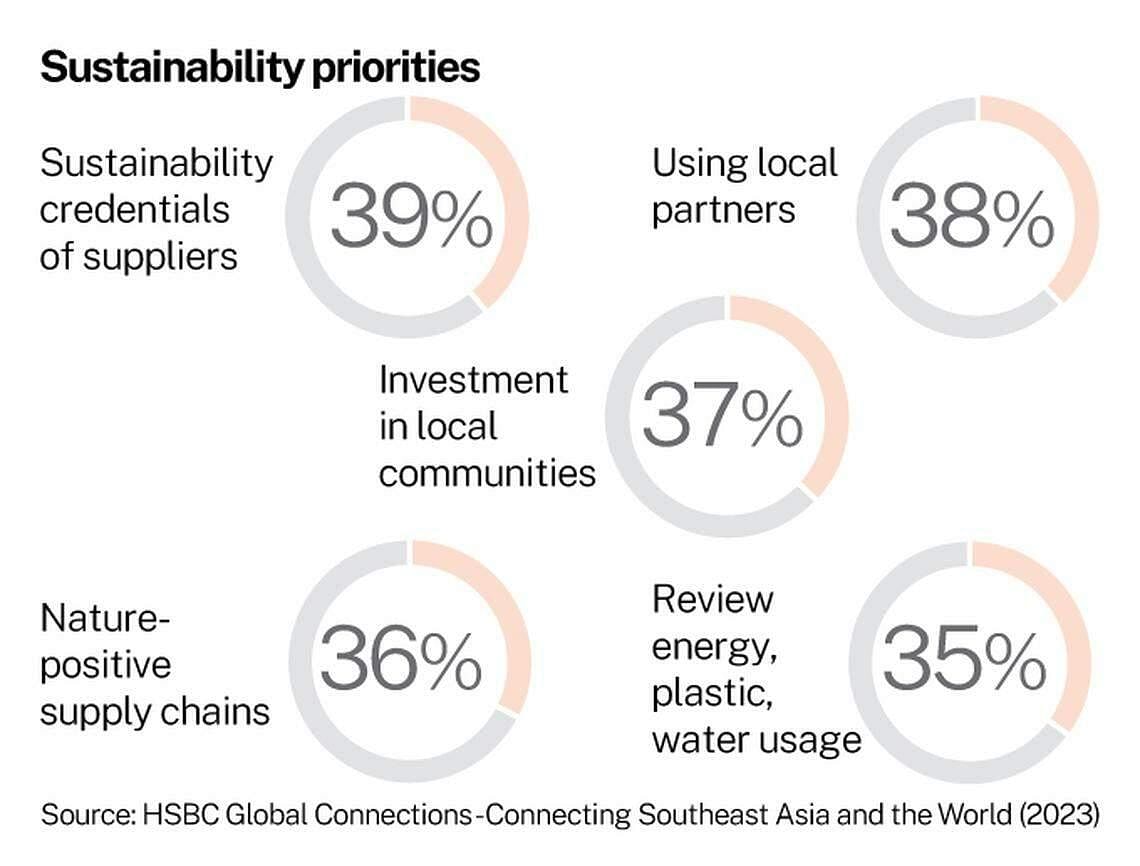

Sustainability

- Businesses plan to invest ~8% of operating profits in sustainability over the next 12 months.

- Financial considerations are a main barrier to becoming more sustainable.

- Four in 10 (41%) have issued green or sustainable bonds, and the same percentage have used sustainability-focused investment funds.

Amanda Murphy, head of commercial banking for South and Southeast Asia, HSBC, said: “Southeast Asia is clearly an attractive manufacturing base, with increasingly advanced supply chains and a highly skilled workforce attracting global firms to the region. However, the consumer story is also one to watch for international businesses as digital adoption and domestic spending power grow.”

December 07, 2023